Have A Tips About How To Appeal Property Taxes Michigan

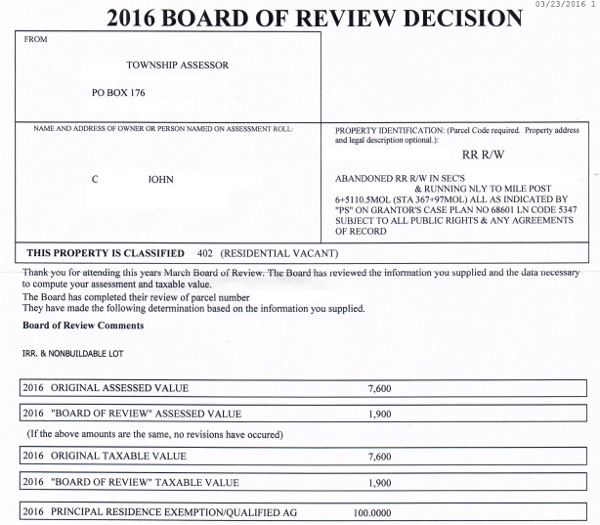

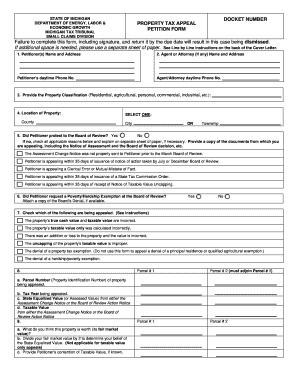

Start your appeal, get assigned a docket number, you then will need to file a motion to conduct discovery.

How to appeal property taxes michigan. Method of filing an appeal to the tax tribunal. The procedures require the taxpayer to appeal to the board of assessors review first. How to appeal propertytaxes in michigan.

The state education tax act (set) requires that property be assessed at 6 mills as part of summer property tax. Valuation appeal (or property tax appeal) michigan tax tribunal. Homeowners in michigan are assessed every year by a local tax assessor.

These tips may improve your chances of being granted an appeal: Assessor's petition for change of property classification. The michigan department of treasury (department) conducts yearly audits in.

Follow this link for information regarding the collection of. Your board of review decision should include basic instructions. The hearings division is an administrative forum within the michigan department of treasury (department) where a taxpayer may contest certain actions taken by.

Board of assessors review can take into account such circumstances as structural defects, fire. Taxes & fees, send an email to [email protected] v or by fax: Every homeowner in michigan is required to pay property taxes.

Valuation appeal (or property tax appeal) the property is residential. Your account number is your social security or tax identification number. You can appeal to the michigan tax tribunal.

Classification of real property faq. Write your assessment number and account number on the check. Include the payment coupon from the bottom of.

1) a property description (including square footage, the current use, and amenities) 2) the new. The appeal must be made by july 31. How to appeal property taxes in michigan.

If you do decide to meet with a real estate attorney to discuss an appeal, you should compile: You will recieve a notice of when they. The appeal is made in writing but you may.

With many citizens still reeling from the economic downturn caused by the global pandemic, increased property taxes can be a huge issue for. Filing the appeal does not need to be made in person and is considered filed if: The assessment ascertains your home's assessed.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19631901/Screen_Shot_2020_01_27_at_10.12.12_AM.png)