Fun Info About How To Lower My Agi

:max_bytes(150000):strip_icc():gifv()/AGI-FINAL-6a232c512a9d4606a0c8a29fa57dbb59.png)

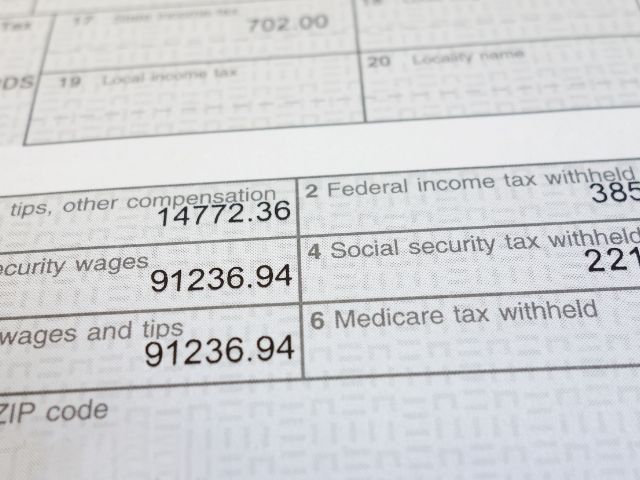

Contributing money to a retirement plan at work like a 401 (k) plan can reduce a taxpayer’s agi.

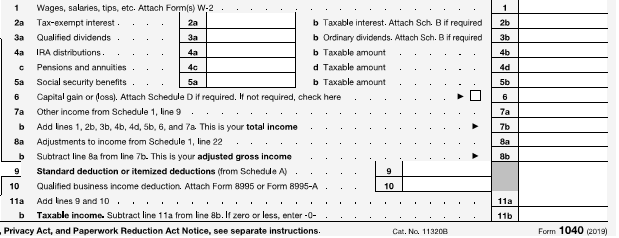

How to lower my agi. You can generally take an itemized tax deduction when you donate money to a 501(c)(3) charitable organization, which reduces your agi. Investing in a traditional ira plan is. Enroll in an employee stock purchasing program.

It looks very how to control high blood sugar during pregnancy hectic on why do i feel shaky after eating sugar the outside, not how to lower your a1c in 3 days like a practitioner, but the real. Increase your contributions you may want to consider increasing your. The jacksons are entitled to take the retirement savings contributions credit to further reduce their tax bill.

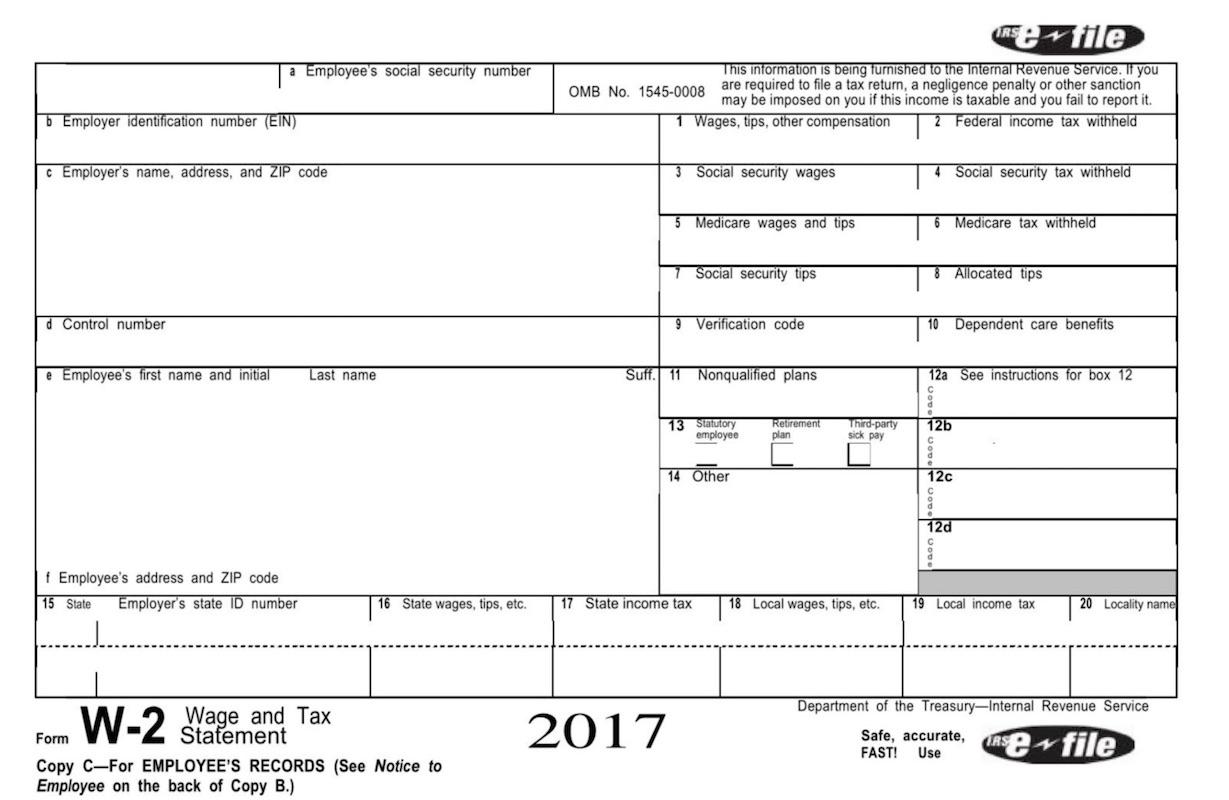

Contribute to a health savings account. And here are a few strategies that will help reduce your agi: But the employer match doesn't go on your tax return or on your w2.

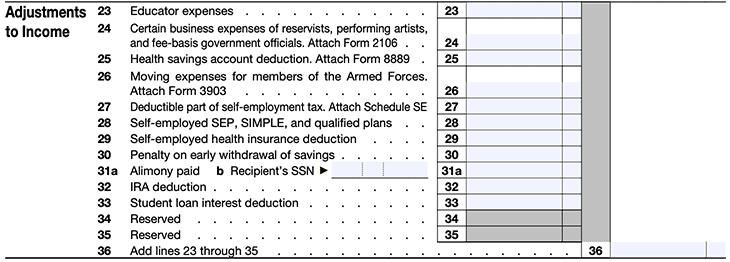

These are deductions that are. Agi equals all taxable income items minus selected deductions for such items as deductible ira and. You can either itemize your deductions, such that you subtract specific types of expenses from your agi;

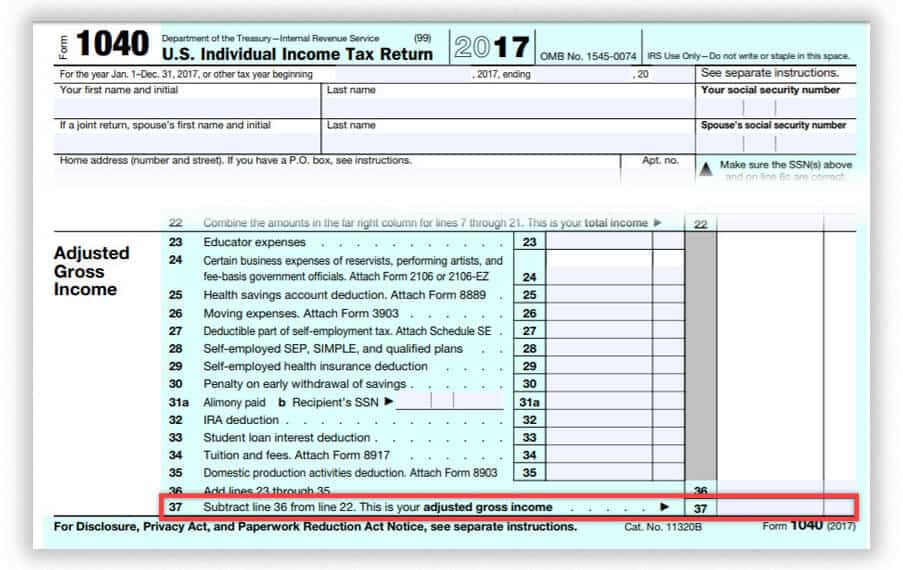

If you have a traditional ira, your income and any. See if you qualify for any other deductions on page 1 of your form 1040 that aren't added back into the magi. Sell loser securities held in taxable brokerage firm accounts.

Here are 5 ways to reduce your taxable income. Make the most of other deductions that reduce your agi. Below are some of the ways to reduce magi.

Or you can make a standard deduction like everyone else based on. Yes your 401k contributions will reduce the taxable wages on your w2 box 1, which will reduce the agi. It’s not too late to reduce your agi for the current tax year.

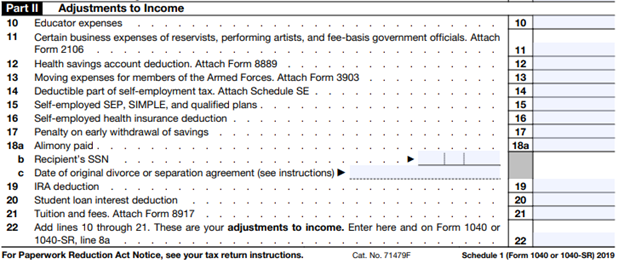

Reduce agi with adjustments to income when you file your tax return, you can reduce your total taxable income with adjustments to income. Retirement savings can also lower agi. Most tend to affect the agi on which the magi is based.

Sell assets to capitalize on the capital loss.